Moratorium: RBI cuts rate by 75 bps, steepest in over 10 years; you can defer EMIs by 3 months | India Business News

The measures are aimed at buying time for the government to deal with the coronavirus crisis by preventing stressed borrowers from being ejected from the banking system and avoiding bond markets going into a freeze due to the sudden cessation caused by the lockdown.

Advancing the monetary policy committee meeting by a week, RBI governor Shaktikanta Das said, “This decision was warranted by the destructive force of the coronavirus. It is intended to mitigate the negative effects of the virus, revive growth, and above all, preserve financial stability.”

Das said that along with earlier measures, the liquidity made available amounts to 3.2% of the country’s GDP.

Coronavirus lockdown: Latest updates

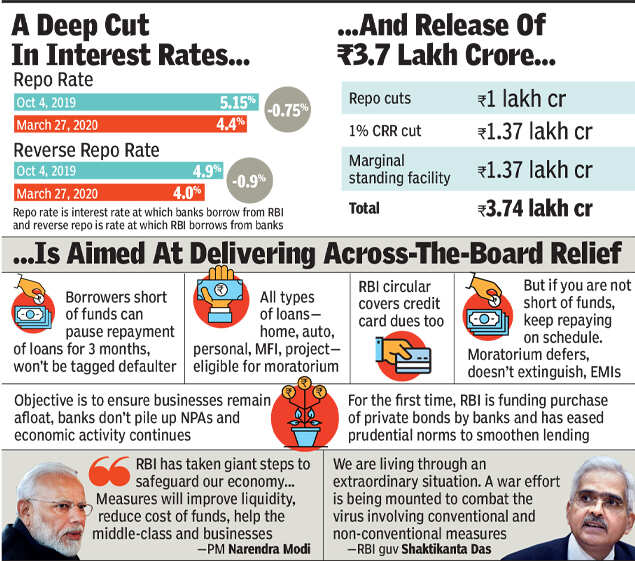

The rate cut had its impact with the State Bank of India cutting interest rates on loans by 75 bps. Besides the conventional rate cut, RBI took an unconventional step of making available Rs 1 lakh crore to banks through targeted long-term repo (lending) operations. This allows banks that have bought bonds from private issuers to finance the purchases at a cheap rate.

Another Rs 1.37 lakh crore was released to banks by reducing the cash reserve ratio (CRR)—a portion of deposits that are impounded by RBI. This reduction in CRR by one percentage point of total deposits will release Rs 1.37 lakh crore to banks. Another Rs 1 lakh crore was made available through a marginal standing facility for emergency loans.

In addition to making available funds, RBI incentivised banks to buy corporate bonds by exempting them from any writedown due to rise in interest rates in future.

To push banks to lend, RBI reduced its reverse repo rate—the rate it offers banks for their surplus funds—by 90 bps to 4%. “The moratorium provides relief to borrowers from being tagged as non-performing assets. Going forward there will be a need to have a restructuring scheme for sectors like hospitality and aviation that are most affected by the crisis,” said Rajkiran Rai, managing director & CEO Union Bank of India.

“As regards the outlook for 2020-21, apart from the continuing resilience of agriculture and allied activities, most other sectors of the economy will be adversely impacted by the pandemic, depending upon its intensity, spread, and duration. If Covid-19 is prolonged and supply chain disruptions get accentuated, the global slowdown could deepen, with adverse implications for India,” said Das.

Coronavirus outbreak: Complete coverage

The measures come on the back of a Rs 1.7 lakh crore relief package for the poor through direct benefit transfer announced by the finance minister on Friday. According to C H S S Mallikarjuna Rao, managing director & CEO , Punjab National Bank, another relief is the RBI decision to defer prescriptions for high capital requirements to September 2020. “However, challenges remain in terms of transmitting these measures to customers amid social distancing. Effective digital and electronic delivery to the last mile will remain the key issue,” he said.

While the stock markets opened positive to the news of an MPC meeting, the sensex closed 131 points lower. “Unlike the Fed or the ECB, the RBI did not announce direct purchases of corporate bonds or commercial paper, but instead passed the buck on to the banks; this could have led to the initial market disappointment post the policy meeting. Moreover, it was disappointing to see no special credit facilities for the worst-hit sectors like aviation, hospitality and an absence of direct liquidity support for the NBFCs,” said Abheek Barua, chief economist, HDFC Bank.